A regime-change signal: maturity crisis in gold?

As I said the other day, I support Barack Obama in the upcoming election. (In fact, at this point I’d like to see John McCain suspend his campaign in the name of national unity.) This means that, like many Americans today, I hope for change. And there’s no change like regime change.

I mean financial regime change, of course. A financial regime change is a phase change in the markets for money—the end of an old era, and the beginning of a new. As I recall, they even had money in Mad Max II: Beyond Thunderdome, so there is always a new regime.

Many eras are ending in the financial industry, but there is one big one which hasn’t happened yet: a regime change in the global currency market. Our current global currency regime is sometimes known as Bretton Woods II, or BWII. Perhaps if the new regime represented only a moderate change from the present one, it might be called BWIII. For policymakers at present, this outcome would probably represent success. In the event of failure, the phrase “Bretton Woods” is unlikely to convey positive brand equity.

No one really loves BWII. Since the term was coined, economists have made a parlor game of predicting its demise. BWII is not an architecture, it’s a system of stable disequilibria. Saying “BWII is coming to an end” is like saying that in the future, California will experience a large earthquake.

A more interesting question is: if there is a market signal—i.e., a price series, a number, a chart—that looks like the end of BWII, what might it look like? By definition, the end of BWII is the end of the world as we know it. So we are, essentially, looking for an end-of-the-world signal.

I am not an economic determinist, so I cannot go so far as to actually predict the end of the world. For one thing, all outcomes are contingent on official action. There are plenty of ways to stop this crisis instantly in its tracks—although most of them are not politically conceivable. At present. Politics is not in any sense predictable.

(Did anyone watch Hank Paulson’s speech on Wednesday? Including the Q&A? You can see it here. Frankly, Bruno Ganz in Downfall is mostly more self-possessed. The kindest thing you can say about Secretary Paulson is that he came across as if he hadn’t slept in three days, and at worst I was reminded of Ed Muskie and his notorious Ibogaine moment. Does Fort Knox come with an “evidence locker”? Even the frame rate on the WMV clip is weird and twitchy, as if Treasury’s IT farm is feeling the heat.)

However, we are now seeing a signal in the wild that, if it means what I think it means, could well be a predictor of global financial regime change. This signal is not one of your common or “headline” statistics. It is not a first-line number or a second-line number or even a third-line number. It is not printed in any newspaper. Nonetheless, you can find it with one click.

But before we say what the signal is, let’s say what it should look like. What we are looking for is a phase change between one equilibrium, which is the equilibrium we have now, and another equilibrium, which is the equilibrium which has Tina Turner, bad hair, and lots of crossbows. From the standpoint of a modeling philosophy which assumes a single equilibrium, such a phase change looks like an indefinite-sigma departure from the original price regime.

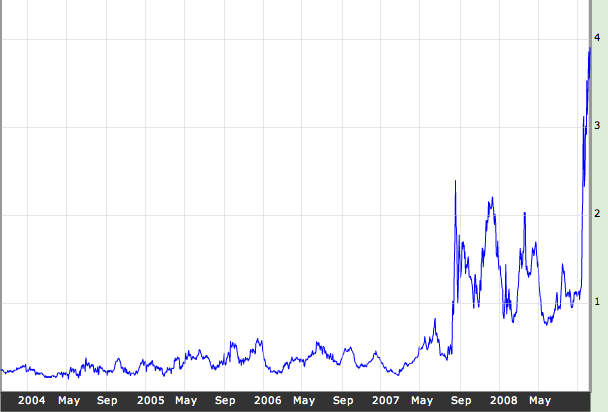

There are all kinds of such departures in the markets today. Perhaps the most notorious is the TED spread, whose recent history looks like this:

Although this signal is very ominous, it is not our candidate. Note that if you graph the inverse of one of these she’s-gonna-blow signals, it assumes the other appearance of an equilibrium-transition signal—the plateau that suddenly turns into a cliff. A lot of the prices of mortgage securities have this plateau-cliff shape.

Nassim Taleb has described these indefinite-sigma departures as black swans. This essay of Taleb’s is required reading. While an equilibrium transition is not the only kind of black swan in the world, it is the bird that seems to be causing the problems we have now.

Here at UR, we think we know what this latest black swan is: a maturity-transformation crisis. A.k.a., a bank run. The previous essay is required reading to understand the rest of this one. If you’re skeptical or even if you aren’t, please also read the discussion at Arnold Kling’s.

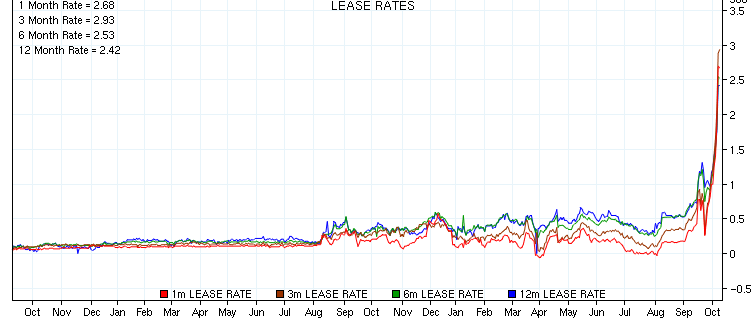

Here is the scary signal:

Again, if this isn’t an indefinite-sigma departure, I don’t know what is. But what is this signal? What are these funny lines, anyway?

This is a gold lease rate—basically, an interest rate for borrowing gold. The source is here. Note that if you scroll down to the long-term chart, you see two other spikes: in 1999 and 2001. The 2001 event is 9/11. The 1999 event was the Central Bank Gold Agreement. These events turned out to be transient, and they are qualitatively different from the current spike—as we’ll see.

The current spike is explained, sort of, in this Financial Times story (also syndicated here). What is not explained is the context and the implications. Let me try to fill in the gaps.

The world’s central banks have about 30,000 tons of official gold reserves. This does not mean they have 30,000 tons of gold in their vaults. No one knows exactly how much gold they have in their vaults. Estimates vary as to the discrepancy, but it is probably somewhere between 2,000 and 10,000 tons. For perspective, annual mining production is about 2500 tons.

The difference is in the form of “deposits,” “loans,” “swaps,” etc.: in a word, receivables. Where X is some number between 2000 and 10000, the CBs have (30,000—X) tons of gold, and (X) little pieces of paper on which is scribbled “HAY CB, ITS OK—I PAY U GOLD.”

The signatures on said pieces of paper are names of “bullion banks.” A bullion bank is just like a regular bank, except that it does business in precious metals, not government currencies. In particular, bullion banks profit the same way regular banks do: maturity transformation.

In a typical transaction, the “deposited” gold is sold on the spot market, and the resulting cash is used to finance a long-term investment, typically gold mining, that produces gold. The result is that the bullion bank has short-term liabilities balanced by long-term receivables, both in gold. In particular, bullion banks generally do not expose themselves to fluctuations in the gold price, as they would if they used their deposits to finance dollar-yielding investments. When the ratio of gold to dollars changes, the bank’s liabilities and assets change in unison.

A similar source of financing is the sale of near-term contracts in the futures market. These contracts promise delivery of gold in a matter of months. The proceeds from their sale can be used to finance production of gold over the course of years. Again, the resulting structure has gold on both sides, and so is balanced against changes in the gold price.

If you have read the essay on MT, all this will seem familiar to you. The bullion banks are maturity transformers. Moreover, they are unprotected maturity transformers—while the gold market is notoriously opaque, there is certainly no one who can print and lend an infinite amount. This being kind of the point of gold.

Note that at least until recently, gold lease rates have been well under 1%, often under 0.1%. Why do central banks participate in this market? The official interpretation is that they want to earn a yield, however small, on their assets. The conspiracy interpretation is that they want to suppress the gold price. In 1998, Alan Greenspan told us that “central banks stand ready to lease gold in increasing quantities should the price rise,” which strikes me as fairly clear-cut. On the other hand, since 1998 the gold price has risen considerably, and gold lending has not.

Most gold enthusiasts, and especially most gold conspiracy theorists (there is no sharp line between the two, especially since gold-market intervention is one of the world’s few practical conspiracies; the whole point of a central bank is to intervene in monetary markets) would have expected that a substantial spike in the gold price, especially one accompanied by general financial chaos, would have resulted in some kind of counter-intervention. Either this has not happened, or it has not been effective.

My bet would be on the former. There is no doubt that central banks once managed gold prices, and very aggressively indeed. But my impression is that the current generation of central bankers has—or had—come to believe its own story, that gold is an industrial commodity whose remaining place in the monetary system is a quirk of history.

As Google Trends suggests, this perception is changing—if nothing else, because BWII is obviously a sick puppy, and the obvious replacement for the dollar as international standard of account would be the material which preceded it. In the very short term, however, I think there are two forces which are causing the stress in the gold market which the curve displays.

One, due to the general financial crisis, there is an enormous increase in Western investment demand for gold, as seen in the now widespread retail shortages. This is sucking present or “physical” gold out of the general bullion-banking complex. While a shortage of coins, small bars, and other refinery products is distinct from a shortage of metal proper, it certainly can’t be said to help.

Two, and much more seriously: as the FT article described, the major gold lenders, central banks, are refusing to roll over their loans. They are certainly not “ready to lease gold in increasing quantities.” If the article is to be believed (and other sources confirm it), they are doing just the opposite.

In other words, they are behaving like rational lenders at the beginning of a maturity crisis. Think about this for a moment from the position of a central banker. You work at the Bank of Elbonia, let’s say, in the gold department. Elbonia has 100 tons of gold left over from its days as a great colonial power, but these days it is pretty much an external province of the United States. For the last ten years, your goal has been to earn a maximum rate of return for the Elbonian people, be it only 0.1%, on these “unproductive assets.” You have operated in an environment where it is essentially assumed that major banks, especially major American banks, simply don’t fail.

Suddenly you realize that major banks, even major American banks, do fail. Moreover, you realize that your vault contains 50 tons of gold, and 50 non-tons of paper reading “HAY CB, ITS OK” etc. (If you don’t understand, see this.) Moreover, you realize that you have not disclosed this ratio, making its disclosure, by definition, news—especially if the disclosure involves informing the public that the non-tons are non-tons. Moreover, you realize that, being a bureaucrat, your prime directive in life is to not get caught with your pants down, and especially not to go to jail, and really especially not to be torn to pieces by a mob in the street. And kind of the last thing the people of Elbonia want to hear right now is that half their gold reserves have gone up in smoke—thanks to you.

Moreover, even if you are not thinking these thoughts, your colleagues around the world are thinking these thoughts. And the logic of the bank run is inescapable: if everyone else is checking out, you want to check out too, and first. Thus, central banks around the world are not “leasing gold in increasing quantities.” They are hoarding it in increasing quantities.

If this maturity crisis continues to develop—there is no guarantee that it either will, or won’t—the inevitable result is what a Mr. Juerg Kiener describes in this helpful CNBC video: a bullion-bank default. Mr. Kiener appears to be what is generally known as a gnome of Zurich. I am confident that he knows much more about gold than I do, so I will take his guess that a delivery default implies a doubling of price as sound. It sounds conservative to me, though.

In a gold maturity crisis, any paper instrument with counterparty risk is unsafe. For example, the price of gold ETF shares, which are backed by 100% metal and have no counterparty risk, may diverge from the price of gold futures, which are essentially claims against bullion banks. It is not possible to predict whether or when this divergence will happen, but it is easy to predict which of the two will go up and which will go down.

From the perspective of BWII, the basic problem with a maturity crisis in the gold market is that it has the capacity to produce a substantial spike in the price of gold in dollars—doubling, etc. Any such spike attracts attention to the possibility of a return to gold as a currency. Because any return to gold as a currency involves an increase in the gold price of at least an order of magnitude, any such attention attracts a shift of dollars into gold. Which increases the price, etc., and so on. I believe this is what Mr. Soros calls reflexivity.

Moreover, the only way to damp a gold maturity crisis is to either find a gold lender of last resort—who would have to be remarkably public-spirited, and display a high level of sang-froid at the possibility of being torn to pieces in the street—or act coercively, confiscating or banning gold. It is not 1933, and present Western governments simply do not have the energy or popularity for this type of action.

So my guess is that unless the lease-rate signal is some kind of fluke (which it might well be), the gold market is likely to default and deflate, the gold price is likely to increase to a level which would at present appear absurd, and the BWII dollar standard will be pushed toward failure and a return to the gold standard.

How this pressure will be resolved depends on the actions of governments. Ideally, they would go with it rather than fighting it. But they certainly have the power to fight it—having, after all, thousands and thousands of tons of gold to sell. However the game plays out, hopefully it will at least play out quickly.